by Patrick Manconi

Dougherty Dispatch/Dougherty Investment Advisors

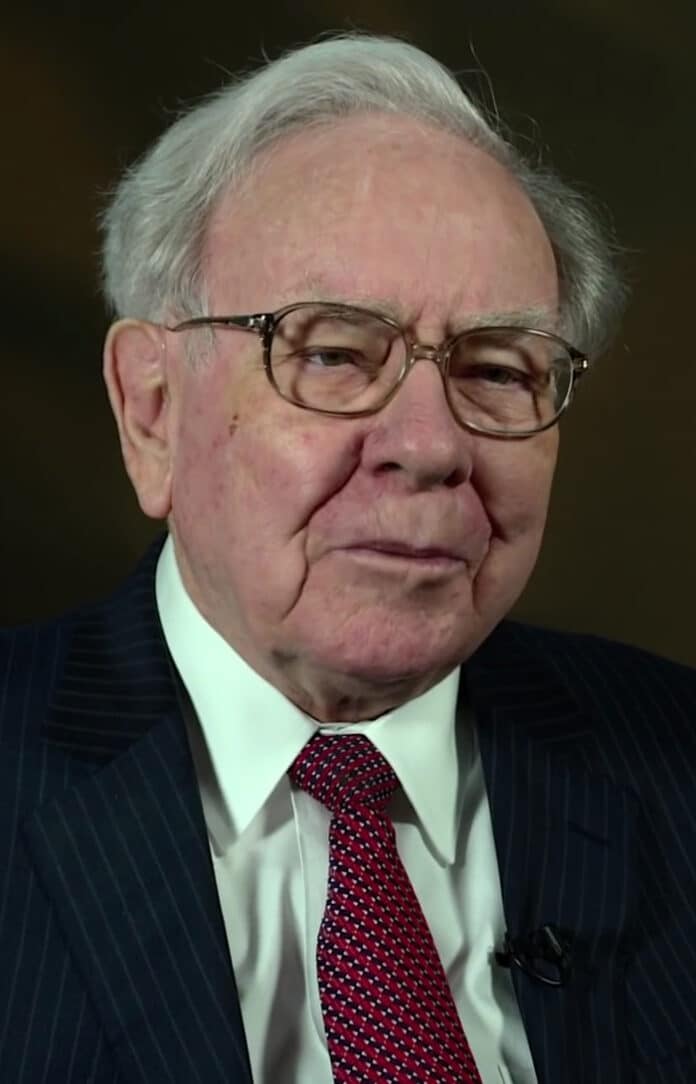

When a recession hits, the first instinct is to abandon the market, sell all sinking assets, and run for the hills away from a poor economy. This is, however, exactly what you need to avoid to earn superior financial results in the long term. The stock market has always been everchanging and volatile since its creation. By applying the same principles Warren Buffett did to become the most successful investor in history, however, we can push through economic downturns, and come out the other side on top.

Applying the principles that Buffett utilized in his investments will allow us to achieve similar financial success. Many people know that Buffett has lived in the same house in Omaha, Nebraska since 1958, and that while driving himself to work, he stops at McDonald’s for the same breakfast every day, along with drinking several diet and cherry cokes. Now that we know what he eats for breakfast, do we understand what his investment philosophy has been that has brought all the success?

Buffett does not listen to what many financial gurus advise, such as trading on short-term periods and trends. Instead, we should never be investing in just stocks; we should always be investing in companies.

“After we buy a stock, we would not be disturbed if the stock markets close for a year or two. We don’t need a daily quote to validate the well-being of our investment,” says Buffett.

The largest amount of wealth from the stock market is always earned in the long term. Buffett is living proof of this. The last thing we should do in the face of a recession or any period of market volatility is to lose faith in businesses that may continue to outperform the competition long after the recession is over.

Our current economic state, like any recession, is a short-term situation that makes us fearful. But, in the words of Warren Buffett, “The size of the investor’s brain is less important than the ability to detach the brain from the emotions.”

The uninformed investor would rather give in to their feelings, sell, and run for the hills than follow the teachings of Buffett. Buffett has taught us to calmly ignore short-term downturns, allow for the market to reset and let our money work for us in the long run as intended.

Rather than running for the hills, a recession is the best time to buy. By getting into the market during a recession, or just keeping the securities we have currently, we give ourselves the best opportunity to see major growth in the future through both the natural appreciation of a stock, and the economic rebound that is bound to occur. As Warren Buffett would say, “The stock market is a device for transferring money from the impatient to the patient.”